In the world of financial services, artificial intelligence (AI) has become a cornerstone of innovation, driving efficiency and enabling capabilities that were once considered impossible. With over 92% of businesses in the sector witnessing profits from their AI investments, it’s clear that AI is not just a trend but a fundamental component of modern financial strategies.

As a standout example of such innovation, Agentforce goes beyond traditional chatbot functionalities to represent the evolution of customer interaction through advanced AI technology.

In this blog, we delve into how Agentforce is revolutionizing the financial industry. So, let’s get started!

How Does Agentforce Transform the Financial Industry?

Agentforce is not a mere chatbot instead it represents the evolution of customer interaction through advanced AI technology. Here’s how Agentforce stands out:

- Increased Productivity: Agentforce automates routine tasks, allowing financial professionals to focus on strategic planning and client relationship management, boosting overall productivity.

- Reduced Manual Tasks: By handling repetitive inquiries, Agentforce frees up staff to address more complex issues, improving problem-solving and decision-making within financial institutions.

- 24/7 Customer Service: Agentforce enables financial institutions to leverage advanced AI technology to enhance customer service, reduce costs, and improve operational efficiency, marking a significant evolution in the way financial services operate.

Transformative Benefits and Industry Trends

The adoption of AI in financial services has led to significant improvements in operational efficiency. Today, around 82% of companies are planning to implement agents by 2027. With Agentforce, institutions have reported a 55% increase in case resolution rates, thanks to AI-powered services. Furthermore, it addresses a critical pain point in the industry, as repetitive tasks consume 41% of agents’ time. Agentforce eliminates this issue by automating routine operations, allowing human agents to focus on more complex and value-adding activities.

How Financial Services Agents Work?

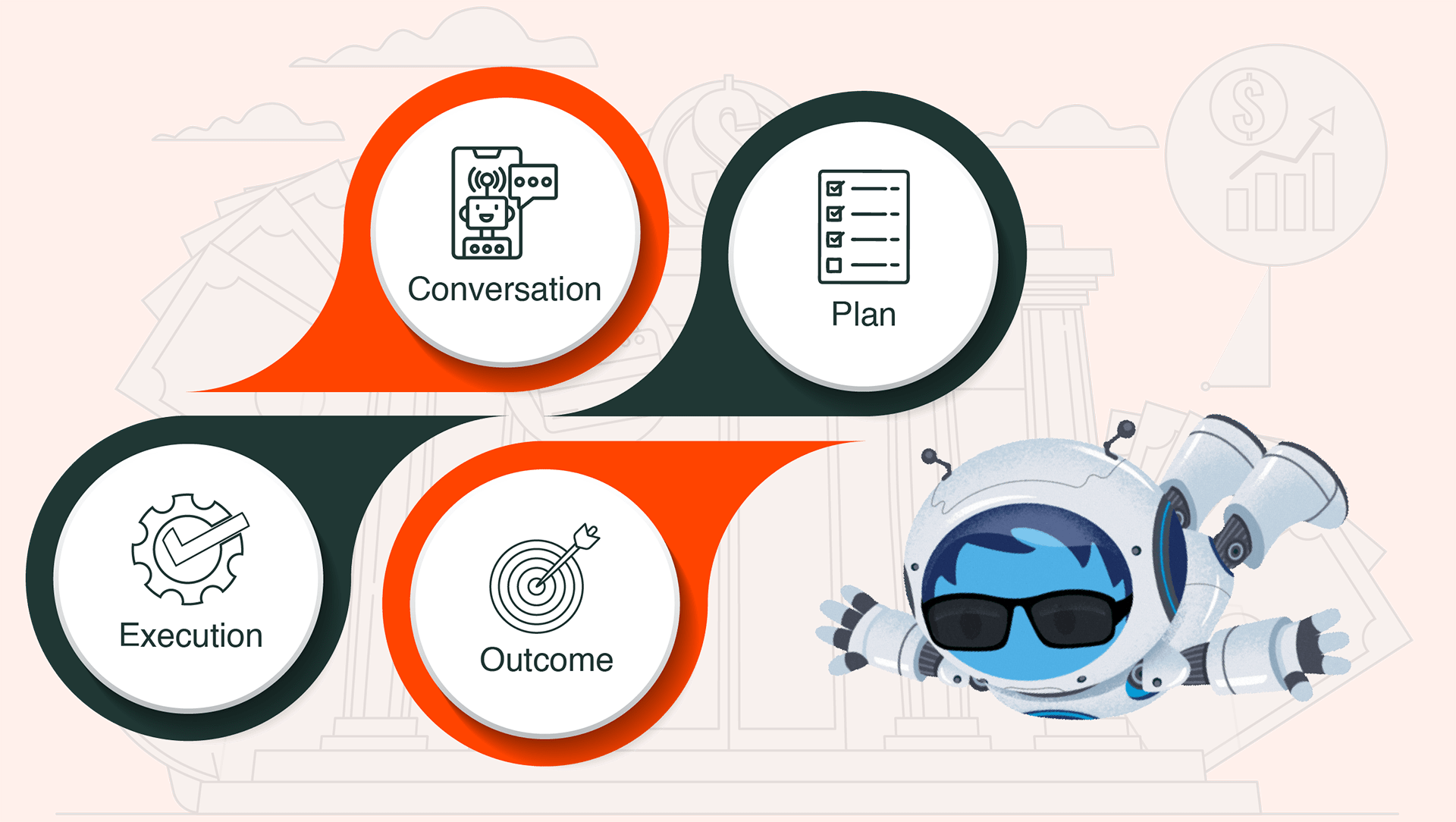

Agentforce transforms traditional service interactions by taking requests from conversation to resolution, all in real time. Here’s a closer look at how a typical financial query is handled seamlessly.

Conversation

The process begins when a customer initiates a service request. Agentforce immediately interprets the intent behind the inquiry and prepares for the next steps through contextual understanding and AI-driven analysis.

Plan

Based on the nature of the request, Agentforce identifies the appropriate service category and applies a predefined set of secure and compliant instructions. This step ensures all necessary validations are in place before proceeding.

Execution

Agentforce then carries out the required actions by:

- Verifying account details

- Retrieving relevant information

- Performing the necessary service actions

- Completing the task with automated precision

These operations are supported by Salesforce’s Financial Services Cloud, Data Cloud, and external systems, all managed securely through the Einstein Trust Layer.

Outcome

Agentforce doesn’t just complete tasks, it delivers outcomes that enhance the customer experience. Within seconds, service requests are resolved with accurate updates, timely confirmations, and seamless execution. The process minimizes manual effort, increases efficiency, and ensures customer satisfaction at every step.

Nespon Solutions: Your Partner in Agentforce Integration

Choosing the right partner for implementing AI solutions like Agentforce is mandatory. Nespon Solutions stands out with a proven track record in Salesforce applications. Our approach includes:

- End-to-End Service: From the initial discovery phase to full deployment and ongoing optimization, Nespon ensures a seamless integration process.

- Tailored Use Cases: We’ve developed industry-specific Agentforce use cases that tackle critical service scenarios. This helps financial institutions streamline operations, enhance accuracy, and speed up resolution times.

The Future is AI-Driven

The integration of AI technologies like Agentforce is not just about keeping up with trends, it’s about setting a new standard in financial services. As we move forward, financial institutions are embracing the latest innovations so they can serve their customers in a much better way.

Interested in exploring how Agentforce can transform your financial services? Contact us at info@nespon.com today to start your journey towards an AI-enhanced future.